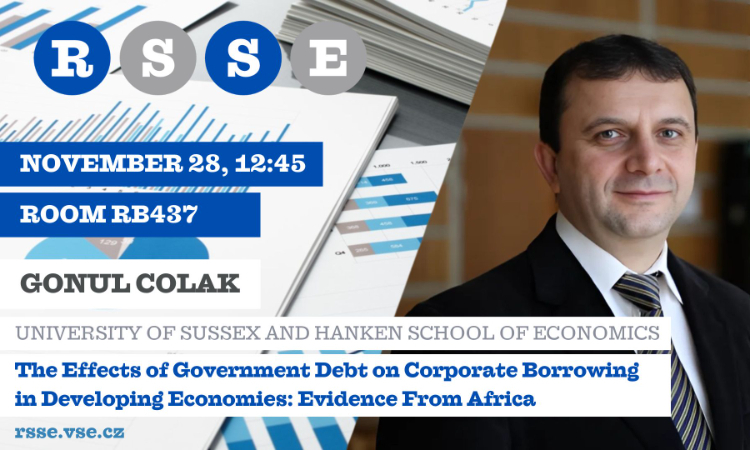

RSSE: Gonul Colak (University of Sussex and Hanken School of Economics, Helsinki) The Effects of Government Debt on Corporate Borrowing in Developing Economies: Evidence From Africa.

| Začátek: | čtvrtek 28. listopadu 2024, 12:45 |

|---|---|

| Konec: | čtvrtek 28. listopadu 2024, 14:15 |

| Místo konání: | RB 437 |

| Online událost: | Microsoft Teams |

| Kontaktní osoba: | Michaela Zemanová |

| Tagy: | #doktorandi #research #rsse #seminar #verejnost #zamestnanci |

It is our pleasure that Gonul Colak (University of Sussex and Hanken School of Economics, Helsinki) will present on Thursday, November 28, 2024, at 12:45 in room RB437 about the topic “The Effects of Government Debt on Corporate Borrowing in Developing Economies: Evidence From Africa.“

Registration is not required and anyone who would like to attend is warmly invited.

It is also possible to participate online via MS Teams at this link.

ABSTRACT: We study the relation between government borrowing and corporate leverage in a manually collected African sample. We find a rarely observed financial crowding-in effect among African firms that is driven by external government debt, whereas domestic government borrowing seems to crowd out corporate borrowing. This crowding-in effect of external government debt is observed in publicly listed firms but not in private firms; it is particularly stronger for foreign listed public firms. We test for several alternative explanations. Following the sovereign credit downgrades the crowding-in effect intensifies, suggesting that the Sovereign Ceiling hypothesis is strongly binding in African countries. The crowding-in effect is also stronger in countries whose external debt financing relies heavily on the Eurobond markets. Non-market-based lending such as concessional loans from multilateral organizations cannot explain this crowding-in effect in public firms, but these loans seem to create a domestic lending boom that primarily increases the leverage of private firms. These findings contribute to the international capital structure literature by highlighting the distinctive characteristics of African debt markets and corporate access to them.

BIO: Gonul Colak is a Professor of Accounting and Finance and an interim Head of Department to the Department of Accounting & Finance at The University of Sussex. Between September 2022 and November 2024, he also served as the Director of Research in the same department. Since January 2022, he holds a fractional Professor of Finance position at Hanken School of Economics, where he served as the director of the PhD program in finance. Recently, he was a visiting scholar at Stern School of Business in New York University, Fordham University, and Turkish Central Bank’s Istanbul School of Central Banking in Turkey. Previously he held academic positions at Florida State University and Wichita State University. He also served as the chairman of the Graduate School of Finance (GSF) in Finland and was a member of the board in the Nordic Finance Network (NFN). He was also a member of the international advisory board of Sebelas Maret University in Indonesia. He currently serves as an associate editor in Journal of Financial Stability and The Financial Review.

His past academic work focused on corporate restructurings, equity issuance, political uncertainty, financial econometrics, firm capital structure, and corporate governance. He has publications in high-quality journals such as Review of Financial Studies, Journal of Financial Economics, Journal of Financial and Quantitative Analysis, Review of Accounting Studies, Journal of Business Ethics, Journal of Financial Intermediation, and Journal of Corporate Finance. According to Scopus his published work has been cited around 1100 times, some of which are in high impact journals. His current research interests cover variety of topics such as external financing of firms, CEO incentives, financial accounting, exchange delistings, investor relations, ESG/CSR, financial intermediation and banking, and monetary policy transmission.